Do you know where your money goes? Do you spend your whole paycheck, or you save some for later? Some experts say we should start saving money for a pension fund as soon as we get the first job. But the question is – should you set up a private pension, such as SMSF (Self Managed Super Fund) or should you be okay with workplace pension scheme only?

Usually, workplace pension is based on the number of years you have been employed and your monthly salary. On the other hand, a private pension fund such as SMSF gives you a full control over the amount of money you put in. Before we analyze the advantages of SMSF and disadvantages too, let’s go over some basics.

SMSF Basics

SMSF is a type of pension fund you run yourself. This is probably one of the major advantages of Self-Managed Super Fund. The main purpose of this fund is to exclusively provide retirement benefits to the members of the fund. The fund can have four or less members who are also the trustees and can contribute to the fund. In case of self-employed superannuation, members can either get a tax deduction or receive bonus contributions to build the fund.

Every SMSF must have a trust deed – a legal document that sets out the key rules that all fund members must follow to make sure SMSF is in compliance with laws and regulations of ATO (Australian Taxation Office). It also needs to meet the sole purpose test to ensure that the purpose of any SMSF investment is providing retirement benefits to the members. For example, if you want to borrow from SMSF to buy property, you can do it as long as fund members or anyone related to the fund does not use it.

Advantages of SMSF

- Flexibility – We can say that this is probably one of the greatest advantages of the SMSF. This super fund allows you to make important investments according to the specific needs you and the other trustees may have prior or after retirement. SMSF also offers the flexibility to make quick and easy changes to your investment strategies.

- Full Control – With an SMSF, you are the one who decides about the investment strategy and in what assets to invest. But with the full control benefit, come also some other obligations such as you being the one responsible for monitoring the performance and the progress of your SMSF investments.

- Investment Choice – Usually, a pyramid of investment options is available for setting up an SMSF. You can choose options such as direct fixed interest, property investment and international shares. These options are not available with any other retirement fund.

- Tax Control – This is another one of the vast advantages of SMSF; with this fund you have the flexibility and the control over the tax position of the fund. Moreover, you have a wonderful flexibility in terms of leading with tax liabilities.

- Borrowing – Lately, new rules have been introduced into the SMSF, which allow you (under a certain type of arrangement) to borrow a certain amount of money. While there are some limitations, these new rules can be well utilized for you to acquire property from your SMSF.

- Pension Planning – With an SMSF you can transform accumulation into a flexible income. It allows you to take tax-free income after retirement which is a big plus.

- Cost Saving – When compared to other super funds, SMSFs may provide cost savings for you. However, this will depend on your own circumstances.

- Asset Protection – In case of bankruptcy or litigation, your benefits will be protected, even if you need to withdraw some.

Disadvantages of SMSF

- Responsibility – Being a trustee of your own fund requires a considerable amount of work regarding meeting administration and compliance requirements as well as researching and managing investments. But you can address this problem by outsourcing the performance of these obligations to a reputable service provider.

- No access to the Superannuation Complaints Tribunal – This means that any conflict between trustees will have to be resolved privately.

- Financial assistance – As an SMSF trustee, you are not entitled to claim financial assistance from the Government/Regulator in case of a loss of funds over theft or fraud.

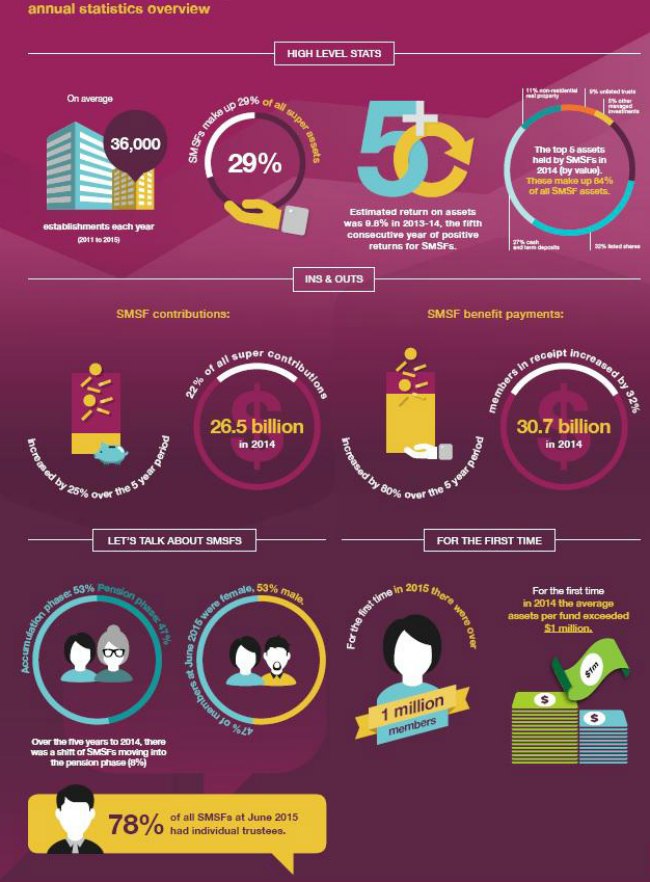

SMSF Statistics

According to the quarterly SMSF statistical report released in June 2015, the numbers of funds and their combined assets have increased by 6% in one year. The report also shows that “the June 2014 quarter estimates for assets held by SMSFs under LRBA (limited recourse borrowing arrangements) have been revised from $9.3 billion to $15.1 billion”. The increase in the estimates can be attributed to some growth in the number of applications of LRBAs by SMSFs and a greater data collection through the new SRBA asset labels on the SMSF annual return.

SMSF Tips

Before you set up an SMSF, it is important that you choose a reputable SMSF service provider to handle it for you. It is important to mention that while some providers offer cheaper prices, their access and professionalism is questionable. In order to choose a reputable SMSF service provider here is what you have to do:

- Find out how long they have been in the market. If the provider has been in the market for only two years or so, pay extra attention, unless the person who runs the business has longer experience in the industry.

- Think well before signing up with a service provider that offers a complete package arrangement that includes service with a wrap account for your investments, a financial adviser, an auditor, a tax agent, a relationship manager and an administration service for your compliance requirements. Aside of charging a great amount of money for these services, they may also charge a percentage on your account balance.

To find out which service provider delivers the best value, ask the following:

- Is there is any advice component?

- What are the costs for setting up an SMSF and trust deed?

- What are the running costs (annual audit, administration and reporting)?

- Are there any extra costs include in the fee?

- What are other possible costs that may arise and are not included in the package?

One important thing to keep in mind, if you find an SMSF service provider asking a cheaper price for establishing your SMSF, be careful! Lower prices usually are followed with higher-end-services later, which is how they make the money.